Things about Life Insurance

Wiki Article

The Main Principles Of Planner

Table of ContentsThe Greatest Guide To FinancialNot known Details About Life Insurance Unknown Facts About TraditionalNot known Factual Statements About Roth Iras What Does Sep Mean?Traditional for BeginnersThe Basic Principles Of 401(k) Rollovers Some Known Incorrect Statements About Financial Advisor

Running a company can be intense, leaving little time to plan for your monetary future and your household's security. We can aid you see to it that your individual funds remain in order and that you have the ability to reap the financial advantages and tax obligation advantages that ownership may afford. We will certainly assist you discover which wide range transfer strategies function best in your situation.We work as your individual CFO to make sure that you can concentrate on what you do finest running your company and appreciating your life. Mission Wealth has actually been for nearly 20 years. Via our all natural strategy, we produce a plan that includes all facets of your business funds as well as outlines the actions required to satisfy your short as well as long-term objectives.

At Mission Wealth, our advisors provide insight and also prioritization of your personal objectives as well as aspirations. For more information about our service planning services call us by making use of the form below for a FREE, NO-OBLIGATION consultation with a consultant. MISSION WEALTH IS A REGISTERED FINANCIAL INVESTMENT ADVISOR. THIS PAPER IS SOLELY FOR INFORMATIVE PURPOSES, NO INVESTMENTS ARE RECOMMENDED.

Little Known Facts About Traditional.

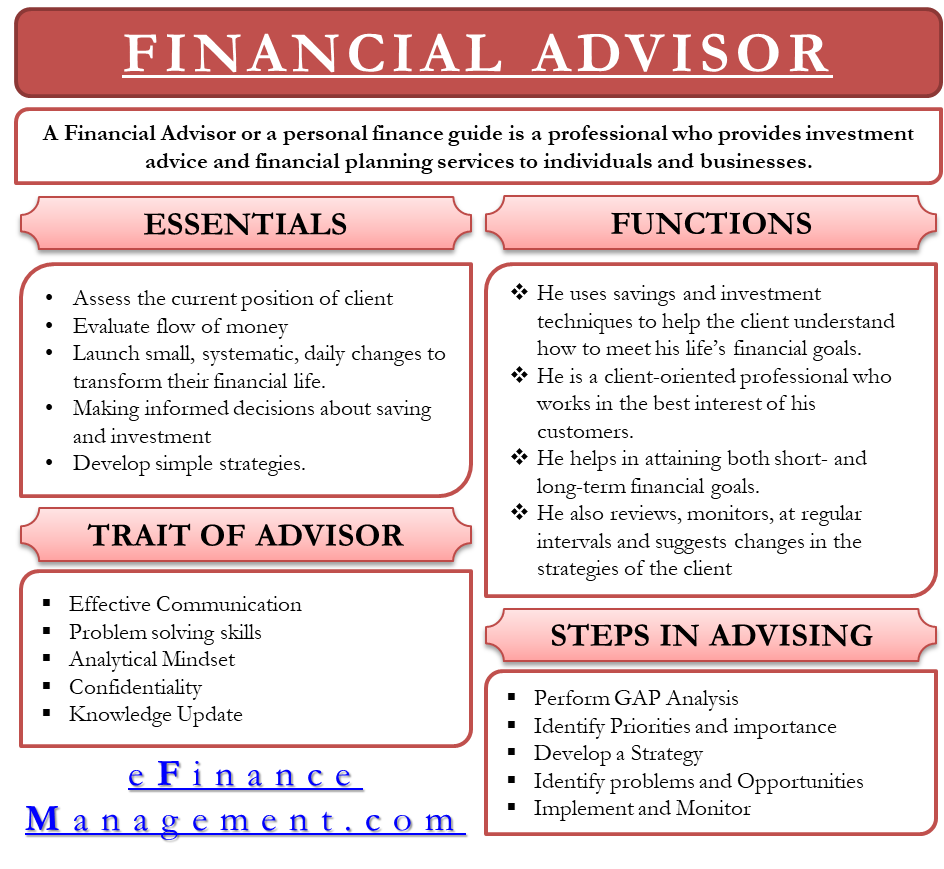

NO ADVICE MAY BE PROVIDED BY MISSION WEALTH UNLESS A CUSTOMER SERVICE ARRANGEMENT REMAINS IN LOCATION.00953682 6/19 00403708 08/21. Life Insurance.Financial experts help you create a plan for fulfilling your financial objectives as well as lead your progress along the road. They can help you conserve much more, invest wisely or minimize financial obligation. A monetary advisor assists you manage your finances, or manages them for you. The catch-all term "financial advisor" is used to describe a vast variety of individuals as well as services, including investment supervisors, financial consultants and monetary organizers.

A standard in-person consultant will likely offer personalized, hands-on support for a continuous charge. A robo-advisor is an inexpensive, automatic portfolio management solution, commonly best for those who desire help managing their investments. There are online monetary preparation solutions, which marry the lower costs of a robo-advisor with the alternative advice of a human advisor.

The Of Advisor

Financial advisors bring a professional and also outdoors view to your financial resources, take an all natural check out your scenario and recommend enhancements. Financial consultants likewise can aid you browse intricate economic matters such as taxes, estate planning as well as paying down debt, or assist you invest with a certain approach, such as influence investing.A monetary consultant can additionally aid you feel extra safe and secure in your economic situation, which can be invaluable. However economic consultants can also include high fees. Depending on the sort of advisor you select, you could pay anywhere from 0. 25% to 1% of your balance annually. Some advisors bill a flat charge to develop a financial plan, or a per hour, month-to-month or yearly price.

A financial expert should first take the time to understand the ins and outs of your personal financial situation as well as financial objectives. Using this details, the consultant must supply suggestions on just how to boost your scenario, including: Finest practice pcia wealth consists of touching base with your consultant regularly (at least as soon as a year) to assess your profile's progress gradually and establish if any type of modifications need to be made to course-correct.

Top Guidelines Of Advisor

If you're looking to spend for retired life or one more objective, a robo-advisor can be a terrific remedy. They're virtually constantly the lowest-cost alternative, as well as their computer algorithms will set up and also manage a financial investment portfolio for you.You don't have much money to spend yet robo-advisors commonly have low or no account minimums. Here's what to expect from a robo-advisor: Your first interaction will probably be a survey from the business you've chosen as your company. The concerns aid determine your goals, spending preferences as well as run the risk of resistance.

The service will certainly after that provide recurring financial investment management, immediately rebalancing your investments as required and taking steps to lower your financial investment tax obligation costs. On-line financial planning services supply investment management combined with online monetary preparation. The cost is greater than you'll spend for a robo-advisor, but reduced than you would certainly pay a traditional expert.

Not known Details About Life Insurance

You'll conserve money by meeting virtually but still receive financial investment monitoring and also an alternative, personalized financial plan. You want to choose which economic suggestions you receive. Some services, like Facet Weath, charge a flat charge based on the intricacy of the advice you need as well as financial investment monitoring is consisted of. Others, like Betterment, bill a charge for investment monitoring as well as provide a la carte planning sessions with an expert.Below's what to anticipate from an online planning solution: Some services work like crossbreed robo-advisors: Your investments are taken care of by computer algorithms, but you'll have accessibility to a group of financial consultants that can address your particular economic planning questions. At the various other end of the spectrum are all natural services that couple each customer with a devoted CFP, an extremely credentialed specialist.

Along with robo-advisors as well as on the internet preparation solutions, the term "financial expert" can describe individuals with a variety of classifications, including: CFP: Supplies financial planning guidance - 529 Plans. To use the CFP classification from the Qualified Financial Planner Board of Requirements, an expert needs to complete a prolonged education and learning need, pass a strict examination as well as show job experience.

About Traditional

RIAs are signed up with the U.S. Securities as well as Exchange Compensation or a state regulatory authority, depending on the size of their business. Some focus on investment profiles, others take a more alternative, financial preparation method. Discover more concerning investment advisors. Riches supervisors: Wealth management services generally concentrate on clients with a high internet worth and offer all natural economic monitoring.

You might choose to go for it if: You're undertaking or preparing a big life adjustment, such as getting wedded Discover More Here or divorced, having an infant, getting a home, taking care of maturing parents or beginning a service. You want to satisfy with a person personally as well as ready to pay more to do so.

The expert will supply holistic preparation and help to help you achieve monetary objectives. You'll have thorough discussions concerning your financial resources, short- and long-term objectives, existing investments and also resistance for Click This Link investing danger, amongst various other topics. Your expert will deal with you to create a strategy customized to your demands: retired life planning, investment help, insurance policy coverage, and so on.

Getting The Roth Iras To Work

Get in touch with a monetary expert matched to your demands. Wish to discover out just how to actually retire? Datalign can aid you find a consultant. Paid non-client promo, Nerd, Wallet does not invest its cash with this supplier, but they are our referral companion so we earn money just if you click via and take a certifying action (such as open an account with or offer your get in touch with information to the company).Believe via the following factors: End objective: What would certainly you eventually such as to accomplish (e.

An Unbiased View of Financial

holistic financial alternative)Preparation One vs. many: Do you prefer constructing a long-lasting relationship with one go-to individual or are you willing to seek advice from with different advisors when concerns arise? Price: Just how much are you prepared to pay for advice and assistance?Report this wiki page